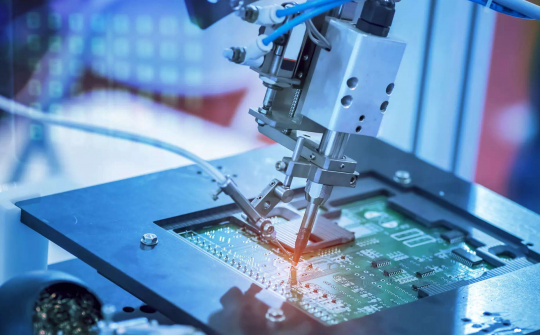

The semiconductor back-end manufacturing sector, which is less capital-intensive than more strategic front-end chipmaking in foundries, but Viet Nam is among the fastest-growing countries in the US$95 billion segment.

Viet Nam's growth in the back-end segment of the chips industry has been encouraged by the Biden administration amid growing trade tensions between Washington and Beijing, which may further escalate with the second presidency of Donald Trump.

Thanks largely to the investments from foreign companies, Viet Nam is expected to have by 2032 an 8-9 percent share of global capacity in chip assembling, testing and packaging (ATP), from just 1 percent in 2022, according to a report published in May by the U.S. Semiconductor Industry Association and Boston Consulting Group.

Reuters quoted Hana Micron's Vice President for Viet Nam, Cho Hyung Rae, as saying that the company was expanding in the Southeast Asian country to meet requests from industrial clients.

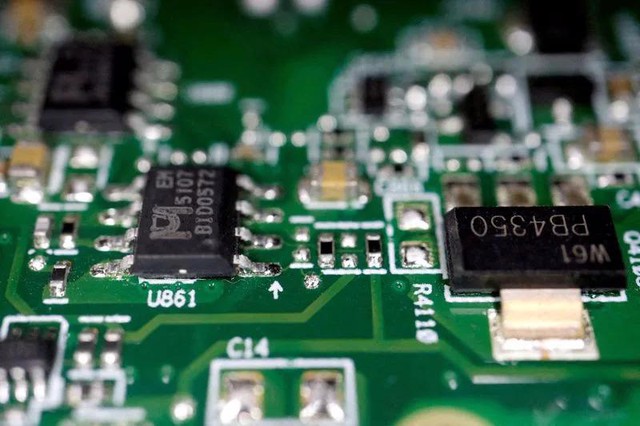

The Korean company is investing about US$930.49 million until 2026 to boost packaging operations for legacy memory chips, a company official based in South Korea said.

U.S.-headquartered Amkor Technology announced last year a US$1.6 billion plan to build a 200,000 square metre (2.2 million sq. ft) factory which it said would become its most extensive and advanced facility, "delivering next-generation semiconductor packaging capabilities."

A business executive with direct knowledge of Amkor's operation in Viet Nam said some of the equipment installed in the new plant had been transferred from factories in China.

Intel, which had a large booth last week at Viet Nam's first international semiconductors exhibition near Ha Noi, has in the country its largest chips back-end factory in its global network.

Meanwhile, local companies are also expected to contribute to the sector's forecast growth.

Earlier, Viet Nam set a target of some US$25 billion a year in revenue from the semiconductor industry by 2030, according to the country's semiconductor development strategy until 2030, with a vision for 2050, issued by the Prime Minister.

The figure will soar to $50 billion a year during the 2030-40 period and US$100 billion between 2040 and 2050./.